Corporate stakeholders, including investors, regulators, NGOs, and media, have raised concerns about the scope, differences, reliability, and comparability of Corporate Social Responsibility Reports (CSR reports). Scholars have not only engaged with quality and reliability issues, but also sought to identify the best methodology and measures for the quality of CSR reports (Yekini et al., 2015). This is because the narrative nature of the reports raises important questions regarding the validity of diverse quantitative measures used in previous studies. For example, should we evaluate CSR reports in terms of quantity (amount or length) or quality (authenticity or reliability)? If it is the latter, what should be the best measure or way to evaluate quality?

Price and Shanks (2005) described disclosure quality as the extent to which i) users perceive the communicated information as meeting or exceeding their expectations and ii) the information enables users to draw meaning out of the disclosed information for informed decision-making. Hence, disclosure quality can be said to be the sensemaking and usefulness that users are able to derive from the communicated information. Evaluating the quality of CSR reports is therefore important because CSR information is intended to show users of annual reports (such as investors and creditors) the intrinsic values of the firm. It is an opportunity for firms to talk their organizational values into existence to channel the ‘intrinsic flux’ of the targeted audience toward certain ends, such as attracting investment or fostering customer loyalty.

A variety of methods for analyzing CSR reports exist in the literature, including a substantive multidisciplinary interest regarding the best way of evaluating the quality of the information in annual and stand-alone sustainability reports. None of these studies, however, attempted to explore the efficacy of a linguistic-based approach.

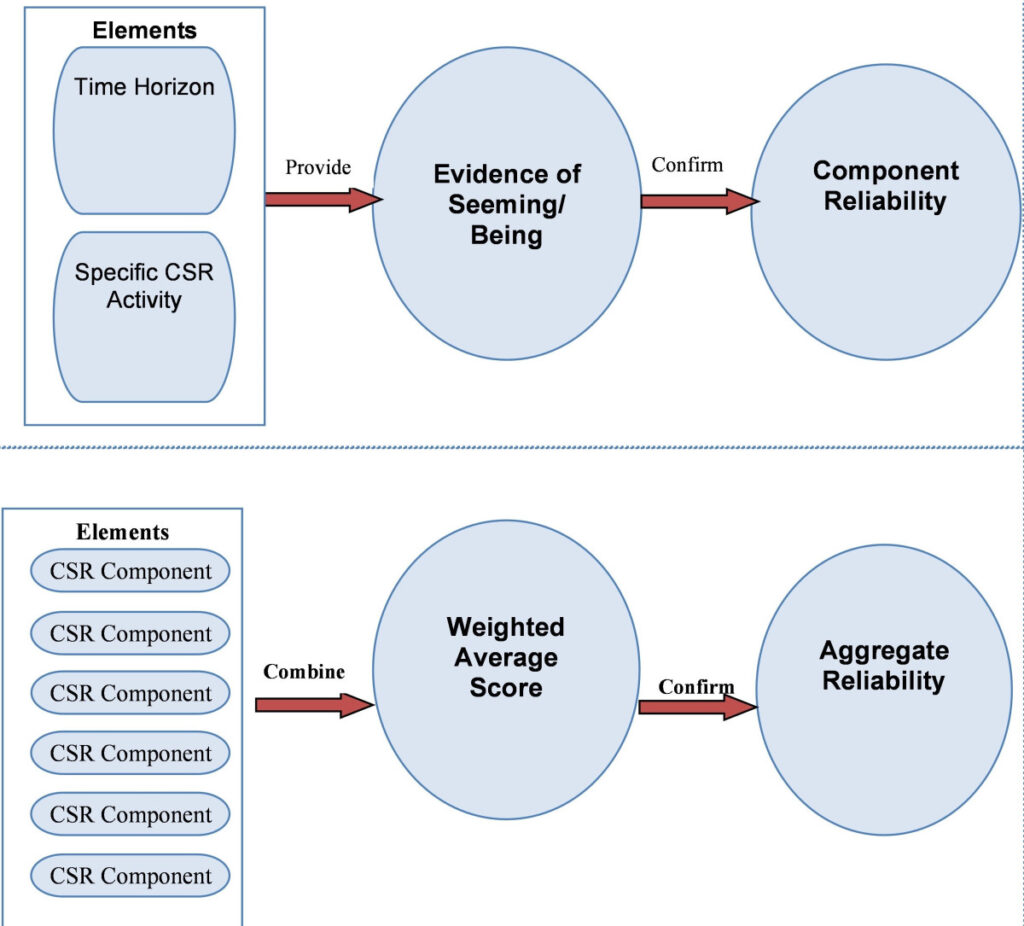

In the article – CSR Communication Research: A theoretical-cum-methodological perspective from semiotics, we developed a CSR reports quality evaluation model (see Fig 1: CSR reports Quality Model) using a linguistic-based theoretical analytical tool, semiotics. Semiotics relates to how a recipient can draw meanings from the signs inherent in the communicated information. Semiotics look beyond the content of the narrative through the interplay of codes and conventions and the application of logical discourses to draw meaning out of the narratives and thus make sense of the information being reported. We argued that the quality of CSR communication would be better construed when the texts of the narratives are subjected to linguistic analysis using semiotics. We explored our model (pp. 892-900) on the UK FTSE100 companies, evaluating the quality of their CSR activities and communications.

In the article – CSR Communication Research: A theoretical-cum-methodological perspective from semiotics, we developed a CSR reports quality evaluation model (see Fig 1: CSR reports Quality Model) using a linguistic-based theoretical analytical tool, semiotics. Semiotics relates to how a recipient can draw meanings from the signs inherent in the communicated information. Semiotics look beyond the content of the narrative through the interplay of codes and conventions and the application of logical discourses to draw meaning out of the narratives and thus make sense of the information being reported. We argued that the quality of CSR communication would be better construed when the texts of the narratives are subjected to linguistic analysis using semiotics. We explored our model (pp. 892-900) on the UK FTSE100 companies, evaluating the quality of their CSR activities and communications.

We found that the CSR quality model is a valuable tool for both management and CSR communication researchers. It can be used for qualitative analysis or as a quantitative measure of CSR quality. As a qualitative analytical tool, it can be used to evaluate the reality and transparency of the underlying organizational values being communicated by the reports. As a quantitative measure of CSR reports’ quality, the model can be used to generate data for statistical analysis by generating a quality score for CSR activities.

The foregoing shows that the linguistic-based CSR Reports quality model could enhance the evaluation of specific corporate disclosure because it lends itself to a systematic but rigorous evaluation of the underlying organizational values communicated by the reports. The model helps to provide a theoretical framework for defining the criteria necessary to establish the reliability and quality of information. Since semiotics is a well-established linguistic theory spanning over 10 decades and has proved suitable for analyzing sign-related communications, the model is grounded on a sound theoretical footing. This is particularly important for managers as the model provides distinctive insights into how to evaluate the quality of CSR communication and an effective way of generating a trend analysis of the firm’s performance in each CSR theme (e.g., educational sponsorship) over a period. This can be a valuable way to monitor the firm’s progress and provide an opportunity to improve CSR activities. It can also serve as a handy tool for an investor in making important economic and social decisions, such as investing in socially responsible investments.

CSR communication researchers should note, however, that the upsurge of Artificial Intelligence (AI) is rapidly gaining ground in text analysis and mining, and has become a potent tool for investigating human cognition. Nevertheless, semiotics offers a critical prospect to appraise the quality of CSR and other narrative disclosures in annual reports. This is because while AI aims to create artificial intelligence that can outperform human intellect, semiotics, as a study of signs, is more applicable to comprehending human reasoning rather than artificial modelling of the human mind. Thus, semiotics remains critical to assessing the quality of CSR reports and can enhance the application of AI by offering insights into human semiosis, which is otherwise challenging to simulate.

References:

Price, R., & Shanks, G. 2005. A semiotic information quality framework: Development and comparative analysis. Journal of Information Technology, 20: 88-102.

Yekini, K., Adelopo, I., Androkopolous, P., & Yekini, S. 2015. Impact of board independence on the quality of community disclosures in annual reports. Accounting Forum, 39: 249-267.

Yekini, K.C., Omoteso, K., & Adegbite, E. 2021. CSR communication research: a theoretical-cum-Methodological perspective from semiotics. Business and Society, 60(4):876-908.