By Bin Li, Lei Xu, Ron P. McIver, Xin Liu, & Ailing Pan

Can the reform of property rightsalso improve the corporate social responsibility (CSR) performance of privately-owned firms? We use the natural experiment offered by China’s mixed ownership reform (the Reform) and an external CSR rating system to explore this puzzle. Our empirical analyses suggest the answer is yes. This is based on two features of the Reform. First is the potential for merger and acquisition (M&A) activity to improve privately owned firms’ access to resources. Second is the need for these firms to maintain organizational legitimacy and support by satisfying external stakeholders’ CSR . Our study, and the implications that we draw from it, are explained in the following paragraphs.

Reform, which allowed China’s privately-owned firms to take equity stakes, and potentially to influence behaviour, in large state-owned enterprises. The Reform targeted large underperforming state-owned enterprises’ resistance to reform, levels of corruption, and abuse of monopolistic power. However, its provisions for a greater private ownership role in large state-owned enterprises’ activities through cross-ownership M&A activity also raised concerns. Amongst these is that China’s privately-owned firms have been lagging state-owned enterprises in terms of CSR engagement, particularly in their ability and willingness to undertake CSR activities and to report on CSR practices.

So, has the Reform supplied an opportunity for privately-owned firms to increase access to resources needed to improve CSR performance? Has it been associated with a reduction in the CSR performance gap between privately-owned firms, which engaged in cross-ownership M&A activity, and that of state-owned enterprises? Were these privately-owned firms more likely to release CSR reports? Although we say ‘yes’ to the first two questions, our responses are qualified. Improvements in CSR performance were only significant for those private sector whose survival may have depended on gaining these extra resources; i.e., those that had greater constraints due to financing and/or limited in access to government subsidies. Engagement in cross-ownership M&A activity did increase CSR reporting. However, only a small proportion of private sector firms chose to undertake such cross-ownership M&A activity.

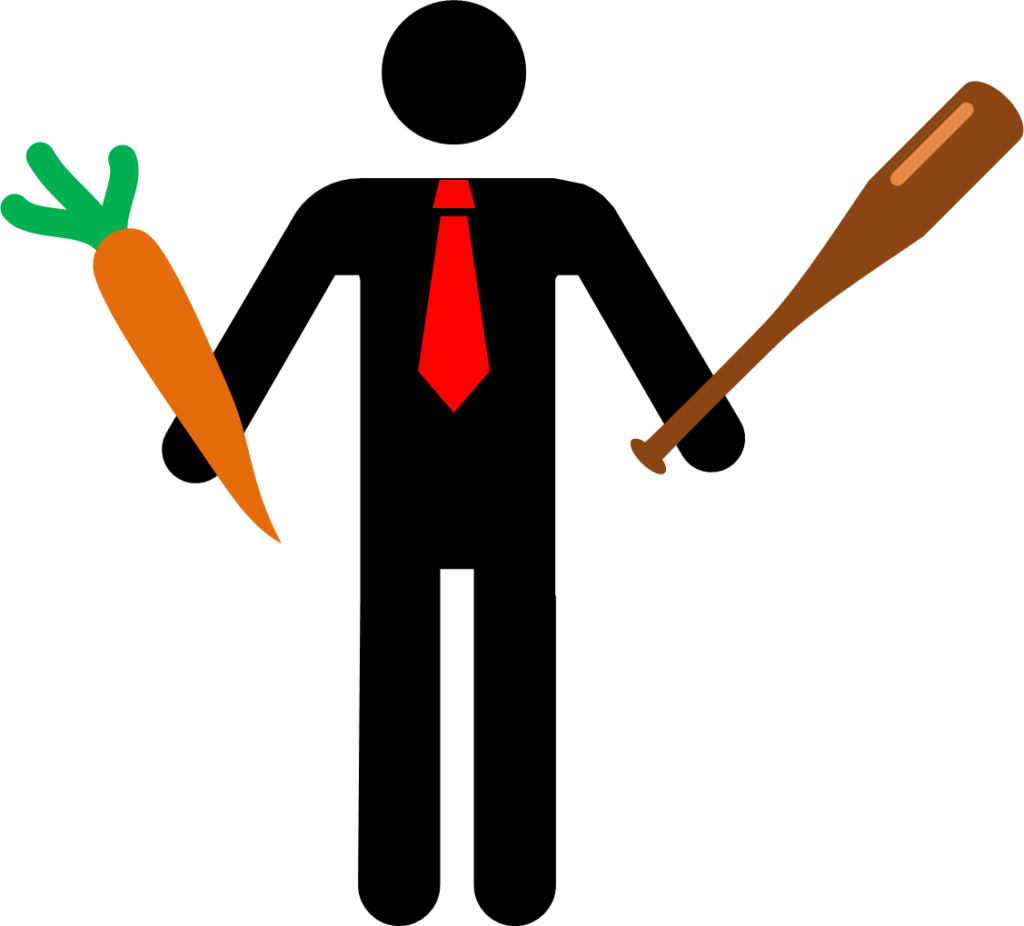

What are the policy implications of our findings? Our research shows allowing purchase of state-owned equity supplies a path for potentially reducing biases against private firms, incentivizing those that engage with the policy initiative to improve CSR performance and reporting. However, the negative impacts of private firms’ lower access to financial and other resources, suggests that China can use more effective approaches to promote CSR engagement. ‘Carrots’ include China improving market access conditions for private firms, and better restraining the ‘visible hand’ of government in allocating resources to state-owned enterprises. The ‘stick’ is the ability to enact explicit CSR disclosure regulation, allowing stakeholder pressure to then drive commitment to improving CSR performance. We believe that by focusing directly on the causes of private sector firms’ disadvantage, carrot and stick policy approaches provide clearer incentive structures, and will more effectively ensure that more of China’s private sector firms improve their CSR engagement.

References

Dong, S. & Xu, L. 2016. The Impact of explicit CSR regulation: evidence from China’s mining firms. Journal of Applied Accounting Research, 17(2): 237-258.

Fan, He. 2014. The long march to the mixed economy. East Asia Forum Quarterly, 6(4): 3-5.

Hubbard, P. & Williams, P. 2014. Some of China’s SOEs are more equal than others. East Asia Forum Quarterly, 6(4): 8-9.

Li, B., Xu, L., McIver, R.P., Liu, X. & Pan, A. 2020. Mixed-Ownership Reform and Private Firms’ Corporate Social Responsibility Practices: Evidence From China. Business and Society, 61(2): 389-418.

Meyer, B.D. 1995. Natural and Quasi-Experiments in Economics. Journal of Business & Economic Statistics, 13(2): 151-161.